This week we talked to Ben and Aaron about tokenizing investment funds, and their solution to help with it.

Listen or Watch!

Subscribe now to never miss an episode again.

If you prefer you can also watch the video podcast.

The Future of Investment DAOs with Capita

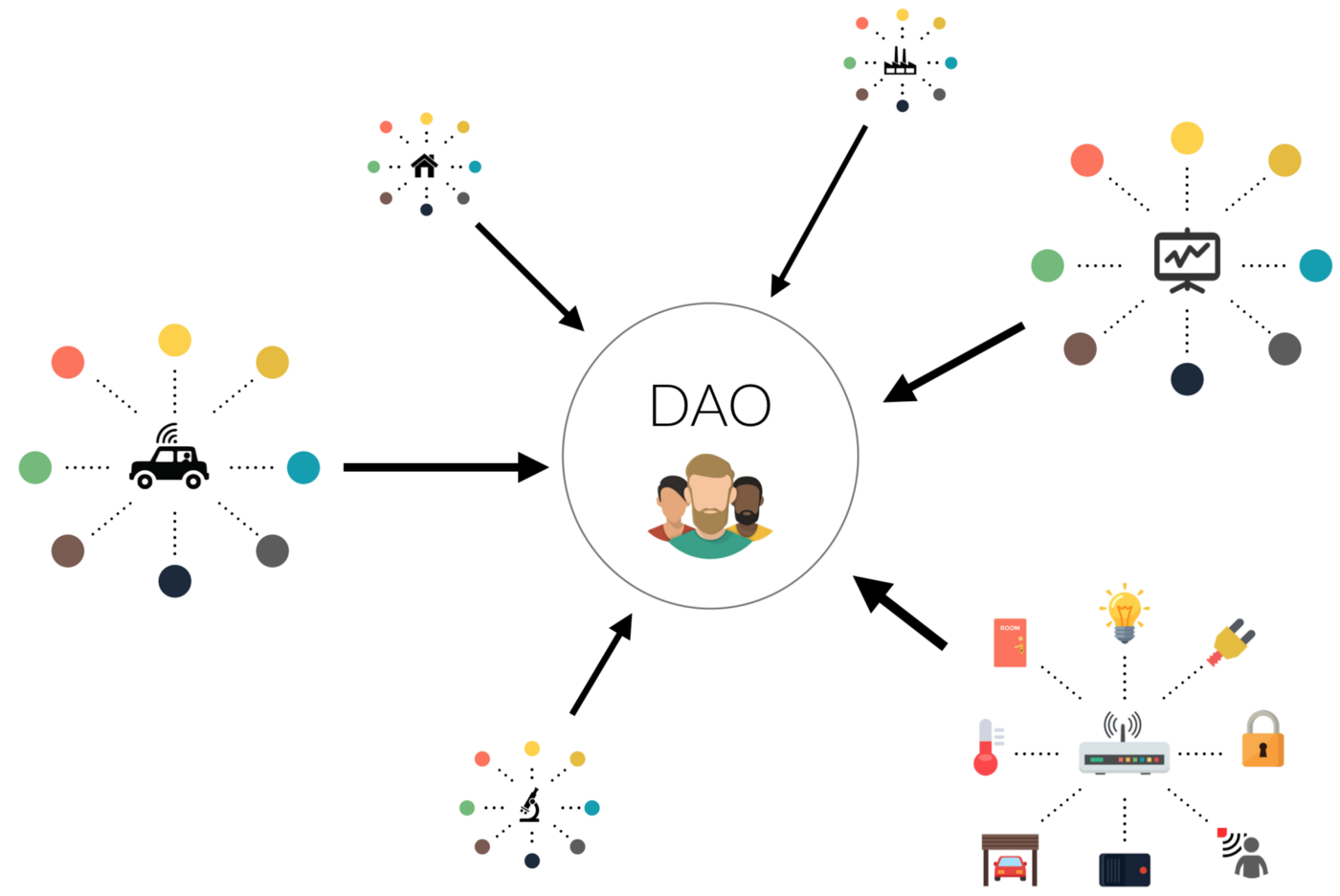

The world of decentralized finance (DeFi) has exploded in recent years, with new applications and protocols being built on blockchain technology every day. One area that has seen significant growth is decentralized investing, where investors can pool their funds together using smart contracts to invest in various assets. This is where Tokenized Investment DAOs come into play.

Tokenized Investment DAOs, or TIDAOs, are decentralized autonomous organizations that allow investors to pool their funds together to invest in various assets, such as stocks, real estate, or even other cryptocurrencies. The key difference between TIDAOs and traditional investment funds is that TIDAOs operate entirely on blockchain technology, using smart contracts to manage investments and distribute profits.

In a recent interview with Ben Su and Aaron Song from Capita, an innovative DAO tooling platform, the duo discussed the future of investment DAOs and how Capita is changing the game. They explained that TIDAOs are built on the principles of decentralization and autonomy, providing investors with more control over their investments and ensuring fairness and efficiency in the market.

According to Ben, TIDAOs built on Capita are designed to be "default compliant," meaning that they are built with compliance features baked into their smart contracts, ensuring that investors are operating within the framework of securities law. This is a significant development, as many DeFi applications have come under scrutiny in the past for operating outside of regulatory frameworks.

One of the key features of TIDAOs is their ability to leverage smart contracts to handle governance and decision-making. Ben and Aaron explained that Capita's TIDAOs use a multi-class token system that allows for different levels of governance rights. This allows for LPs (limited partners) and GPs (general partners) to have different levels of control over the fund, ensuring that decisions are made in accordance with the operating agreement.

Another significant development in the TIDAO space is the ability to create customized smart contracts for each fund. This means that LPAs (limited partnership agreements) can be turned into smart contracts, allowing for a more efficient and cost-effective way to manage investments. This is a significant development, as traditional investment funds often require lengthy legal agreements that can be expensive and time-consuming to manage.

In addition to providing more control and transparency to investors, TIDAOs also offer significant benefits in terms of efficiency and cost-effectiveness. By leveraging blockchain technology and smart contracts, TIDAOs can significantly reduce the cost and time required to manage investments, making them an attractive option for investors of all sizes.

While TIDAOs are still a relatively new development in the world of DeFi, they represent a significant shift in the way that investors approach investing. By leveraging the power of blockchain technology and smart contracts, TIDAOs offer a more decentralized, transparent, and efficient way to invest in assets of all types.

With Capita's innovative DAO tooling platform, the future of TIDAOs looks bright. Capita's platform offers a range of features and tools designed specifically for TIDAOs, including customizable smart contracts, compliance features, and more. This makes it easier than ever for investors to create and manage their own TIDAOs, providing greater access to decentralized investment opportunities for investors around the world.

As the world of DeFi continues to evolve, TIDAOs are poised to play an increasingly important role in the future of decentralized investing. With their ability to provide greater control, transparency, and efficiency to investors, TIDAOs represent a significant step forward in the world of decentralized finance. Whether you are a seasoned investor or just getting started in the world of DeFi, TIDAOs offer a powerful new way to invest in the assets of your choice.